QBE secures $400m of international peak peril reinsurance with latest cat bond

Australia-based global insurance and reinsurer QBE has now successfully completed its latest cat bond issuance to secure a US$400 million international peak risk reinsurance issue by Bridge Street Re Ltd. (Series 2025-2). This is Bridge Street Re’s second issuance of notes and will provide QBE and certain of the company’s underwriting subsidiaries with a $400…

Verisk withdraws from AccuLynx acquisition

Verisk, a provider of data analytics and technology to the insurance and energy industries, has terminated a definitive agreement to purchase AccuLynx, a SaaS platform that provides end-to-end business management workflows for residential property contractors with roofing expertise. The decision comes after the Federal Trade Commission (FTC) informed that it would not be able to…

Global property cat ROL down 12% at Jan 1 reinsurance renewals: Guy Carpenter

Reinsurance broker Guy Carpenter’s Global Property Catastrophe Online (ROL) Index fell 12% at renewal on January 1, 2026, with each risk allocation flat to down 15%, depending on region. Guy Carpenter said in his January 1, 2026 reinsurance renewal report that reinsurers continue to benefit from high attachment points, which is reflected in their lower…

HW International B.V. to rebrand as Dubois

HW International BV, a privately held specialist insurance brokerage group headquartered in the Netherlands, plans to adopt Dubois as its new trading name, effective in early 2026. HW International BV supports clients worldwide, providing specialist insurance advice and customized risk solutions specific to their businesses and risks. Its expertise spans fine art and collectibles, film…

Whitecap confirms space underwriting capacity from Jan 1

Reinsurance managing general agent Whitecap Underwriting Europe sro will start its aerospace underwriting business on January 1, 2026 through its subsidiary Whitecap Aerospace. Whitecap Aerospace will deploy up to $8 million in funding from a Class A insurance company for launch, commissioning and on-orbit satellite risks. Whitecap Space Director Tim Wright will host the course…

Topsail Re joins Mutual Re’s ownership group

Topsail Re, a Cayman Islands-domiciled reinsurer, will join Mutual Re’s ownership group effective January 1, 2026, joining Farm Bureau Mutual of Michigan, Farm Bureau Mutual of Kentucky, Motorists Mutual (Encova Mutual Insurance Group) and Mutual of Virginia. Mutual Re is a joint reinsurance underwriting association that underwrites business through reinsurance intermediaries and is headquartered in…

Risksmith Insurance launches DIC earthquake offering for property risks

Risksmith Insurance Services, a specialist managed general underwriter (MGU) specializing in insurance solutions for complex excess and surplus (E&S) risks, has launched a seismic program that provides flexibility, deep technical expertise and underwriting appetite for difficult property risks. Risksmith’s new Difference in Condition (DIC) earthquake insurance program caters to risks that many markets typically avoid,…

Buyers benefited from favourable dynamics at Jan 1 reinsurance renewals: Aon

Global insurance and reinsurance brokerage group Aon reports that competition among U.S. reinsurers is particularly fierce as protection buyers take advantage of favorable 1.1 renewal dynamics. Aon will publish its full January 2026 Reinsurance Market Dynamics Update report next week, but in the meantime, the broker has provided some insight into its 1.1 analysis. The…

Marsh UK renews Slipstream with lead insurer Markel

Marsh UK has announced the renewal of its dedicated maritime, freight and logistics facility Slipstream, with Markel as primary insurer. “As the industry continues to face volatility due to chokepoints on multiple trade routes, Slipstream is offering 20% of Lloyd’s capacity with a 2.5% placement discount,” said Jay Payne, chief executive of maritime, freight and…

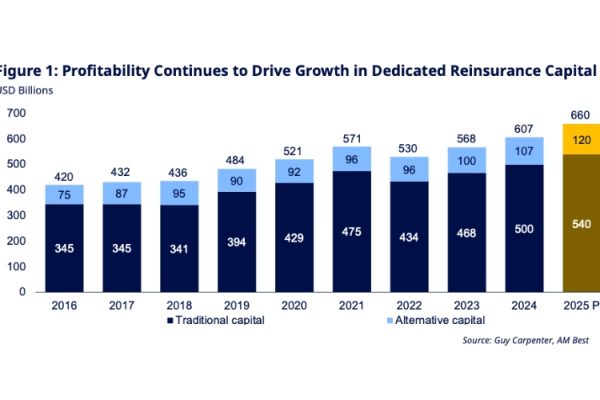

Dedicated reinsurance capital to reach $660bn in 2025: Guy Carpenter

According to Guy Carpenter’s January 2026 update, dedicated reinsurance capital is expected to grow around 9% in 2025 to $660 billion, driven by 10% growth in alternative capital. Guy Carpenter President and CEO Dean Klisura explained that this capital growth was supported by underwriting profits, retained earnings, asset value recovery and strong investor interest, particularly…