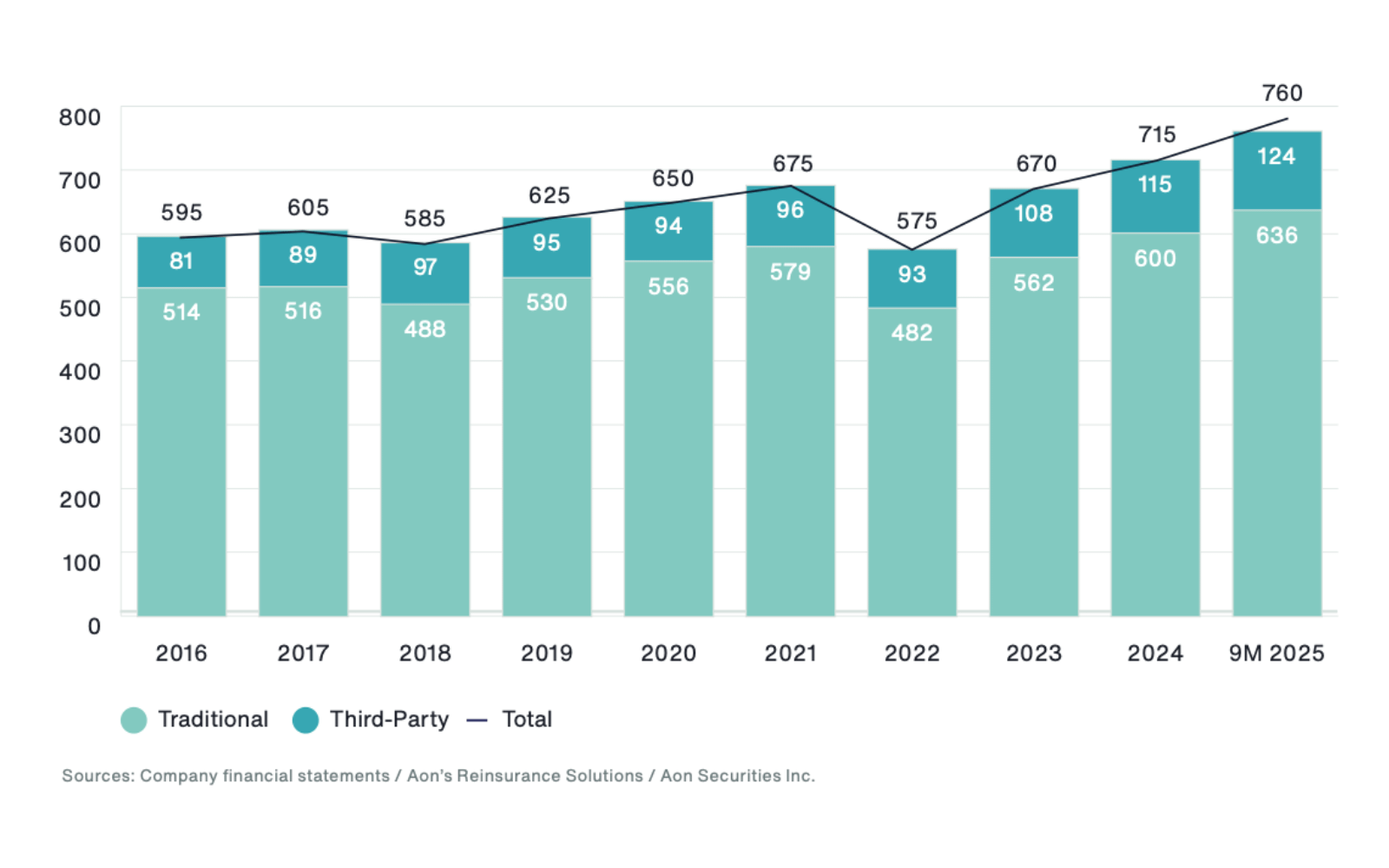

According to Aon’s January 2026 Reinsurance Market Dynamics Report, as of September 30, 2025, global reinsurer capital increased by more than 6% to US$760 billion from the end of 2024, with both traditional and alternative capital growing, mainly driven by retained earnings, unrealized gains, and new inflows from the sidecar and catastrophe bond markets.

Last week, insurance and reinsurance brokerage group Aon released some headline figures from its January 2026 reinsurance renewals report, which has now been released in full.

One of the data points briefly discussed in the report released last week was that global reinsurer capital reached a new high in the first nine months of 2025, increasing by $45 billion from the end of 2024 to the aforementioned $760 billion.

Among them, traditional capital accounted for US$636 billion, an increase of 6% from US$600 billion at the end of 2024, or US$36 billion; alternative capital or third-party capital increased by nearly 8% to US$124 billion, an increase of nearly 8% from US$115 billion at the end of December 2024.

“Growth was driven by retained earnings, unrealized gains on bonds that were rolled directly into equities, and new capital inflows into the sidecar and catastrophe bond markets,” Aon said.

The broker noted that investment in newly rated start-up reinsurers will remain very limited through 2025. Meanwhile, on the other side of the market, Aon said increased investor interest is driving down retrocession costs and enabling traditional reinsurers to expand their sidecar and/or catastrophe bond programs.

According to Artemis, our sister publication focused on insurance-linked securities (ILS), catastrophe bond issuance set a number of records in 2025, with issuance exceeding $25 billion, a record high and annual issuance exceeding the $20 billion mark for the first time.

In addition to capital levels, Aon’s latest reinsurance industry report also explores the performance of traditional reinsurers and claims that most companies will post strong results again in 2025, despite a costly start to the year caused by record wildfire losses in California, as the move away from frequency risk has led to the primary market taking on a greater share of so-called secondary risk losses.

“As a result, most reinsurers have maintained their annual major loss budgets at healthy levels and the average combined ratio for the nine-month period across the 23 companies surveyed was 91.0%, reflecting strong underlying margins,” the report explains.

The average combined ratio for the 23 reinsurers in September 2025 was 91%, compared with 91.3% for the full year of 2024, 90.7% for the full year of 2023, and 96.2% for the full year of 2022 (before the real estate market reset).

“Investment returns continue to provide strong support for overall earnings. The average common yield, primarily related to interest and dividend income, remained at 4.1% on an annualized basis through the first nine months of 2025. Mark-to-market gains on bonds and equities significantly improved total returns,” the report continued.

Return on average equity (ROE) was also strong at 16% in Sep’25, compared with 15% in 2024 and 17.6% in 2023, after reinsurers failed to meet their cost of capital for several consecutive years.

“Traditional reinsurance capital is at very high levels relative to the risks underwritten today and continues to increase, net of significant returns to investors. This capital weight is increasing competition, softening pricing and increasing focus on alternative growth pathways, including strategic M&A, product innovation and diversification to complement organic growth plans,” Aon said.