Global property cat ROL down 12% at Jan 1 reinsurance renewals: Guy Carpenter

Reinsurance broker Guy Carpenter’s Global Property Catastrophe Online (ROL) Index fell 12% at renewal on January 1, 2026, with each risk allocation flat to down 15%, depending on region. Guy Carpenter said in his January 1, 2026 reinsurance renewal report that reinsurers continue to benefit from high attachment points, which is reflected in their lower…

HW International B.V. to rebrand as Dubois

HW International BV, a privately held specialist insurance brokerage group headquartered in the Netherlands, plans to adopt Dubois as its new trading name, effective in early 2026. HW International BV supports clients worldwide, providing specialist insurance advice and customized risk solutions specific to their businesses and risks. Its expertise spans fine art and collectibles, film…

Whitecap confirms space underwriting capacity from Jan 1

Reinsurance managing general agent Whitecap Underwriting Europe sro will start its aerospace underwriting business on January 1, 2026 through its subsidiary Whitecap Aerospace. Whitecap Aerospace will deploy up to $8 million in funding from a Class A insurance company for launch, commissioning and on-orbit satellite risks. Whitecap Space Director Tim Wright will host the course…

Topsail Re joins Mutual Re’s ownership group

Topsail Re, a Cayman Islands-domiciled reinsurer, will join Mutual Re’s ownership group effective January 1, 2026, joining Farm Bureau Mutual of Michigan, Farm Bureau Mutual of Kentucky, Motorists Mutual (Encova Mutual Insurance Group) and Mutual of Virginia. Mutual Re is a joint reinsurance underwriting association that underwrites business through reinsurance intermediaries and is headquartered in…

Risksmith Insurance launches DIC earthquake offering for property risks

Risksmith Insurance Services, a specialist managed general underwriter (MGU) specializing in insurance solutions for complex excess and surplus (E&S) risks, has launched a seismic program that provides flexibility, deep technical expertise and underwriting appetite for difficult property risks. Risksmith’s new Difference in Condition (DIC) earthquake insurance program caters to risks that many markets typically avoid,…

Buyers benefited from favourable dynamics at Jan 1 reinsurance renewals: Aon

Global insurance and reinsurance brokerage group Aon reports that competition among U.S. reinsurers is particularly fierce as protection buyers take advantage of favorable 1.1 renewal dynamics. Aon will publish its full January 2026 Reinsurance Market Dynamics Update report next week, but in the meantime, the broker has provided some insight into its 1.1 analysis. The…

Marsh UK renews Slipstream with lead insurer Markel

Marsh UK has announced the renewal of its dedicated maritime, freight and logistics facility Slipstream, with Markel as primary insurer. “As the industry continues to face volatility due to chokepoints on multiple trade routes, Slipstream is offering 20% of Lloyd’s capacity with a 2.5% placement discount,” said Jay Payne, chief executive of maritime, freight and…

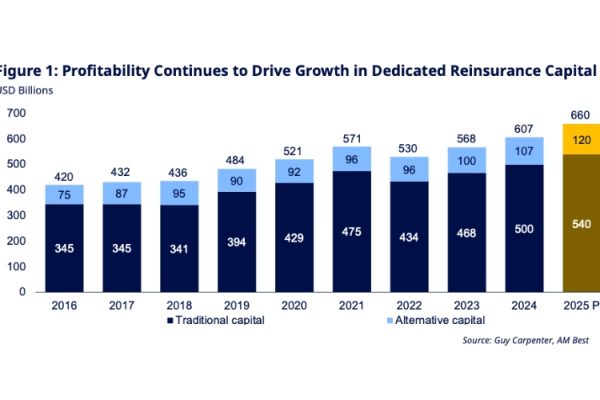

Dedicated reinsurance capital to reach $660bn in 2025: Guy Carpenter

According to Guy Carpenter’s January 2026 update, dedicated reinsurance capital is expected to grow around 9% in 2025 to $660 billion, driven by 10% growth in alternative capital. Guy Carpenter President and CEO Dean Klisura explained that this capital growth was supported by underwriting profits, retained earnings, asset value recovery and strong investor interest, particularly…

Triple-I reports early signs of stabilisation in US homeowners insurance market

总部位于美国的保险业研究和教育组织保险信息研究所 (Triple-I) 表示,不断上涨的保费和更严格的保险范围选择继续对全国各地的家庭预算构成挑战。 与此同时,Triple-I 报告称,尽管人们对负担能力的担忧仍然普遍存在,但房主保险市场已开始显示出稳定的早期迹象。 Triple-I 的最新问题简报表明,美国房主保险领域的净承保保费预计将在 2025 年实现两位数增长。Triple-I 进一步预测,该领域可能会在 2026 年恢复整体盈利,这一转变可能会逐渐改善市场状况,并随着时间的推移支持保单持有人的定价更加一致。 Triple-I 解释说,通货膨胀、高昂的重建成本和持续的气候相关损失仍然是影响保费和承保范围的主要因素。该组织指出,洛杉矶山火造成的损失导致第一季度房主承保业绩出现自 2011 年以来最弱的水平。 然而,Triple-I 报告称,2025 年第二季度业绩显着改善,直接损失率降至 58.9%,为 15 年来最强劲的第二季度业绩。尽管有所改善,但 Triple-I 强调,许多房主仍然面临着保险费用上涨带来的财务压力。 根据 Triple-I 预测,房主保险的净综合成本率预计将在 2025 年达到 107.2,较 2024 年提高 7.5 个百分点,但仍高于盈利阈值。 Triple-I 预计 2025 年净承保保费增长 11.8%,略低于前两年,但与持续的通货膨胀和损失模式一致。 Triple-I 还报告称,2025 年第二季度房屋直接发生损失率比 2024 年同期提高了约 22 个百分点。 Triple-I 的数据显示,2024 年,房主保险占美国所有财产和伤亡保费的 15.6%,突显了该领域对整个行业业绩的重要性。 Triple-I 指出,影响保费增长的经济因素从 2024 年的负贡献转变为 2025…

SanlamAllianz Re appoints Shawn Kriedemann as CUO

SanlamAllianz Reinsurance, the reinsurance arm of SanlamAllianz, announced the appointment of Shawn Kriedemann as Chief Underwriting Officer (CUO), effective January 1, 2026. Kriedemann has more than 35 years of experience in Africa and Europe and has strong technical expertise in claims, underwriting and reinsurance. He joined SanlamAllianz Re in June 2023 as Treaty Manager. Prior…