Arthur J. Gallagher acquires Germany-based Reck & Co

Arthur J. Gallagher & Co., a global insurance brokerage, risk management and advisory services company, announced that its claims and risk management solutions subsidiary Gallagher Bassett has acquired Reck & Co GmbH (Reck & Co.). Headquartered in Bremen, Germany, Reck & Co. is a specialist provider of global transport and marine claims services, including surveying,…

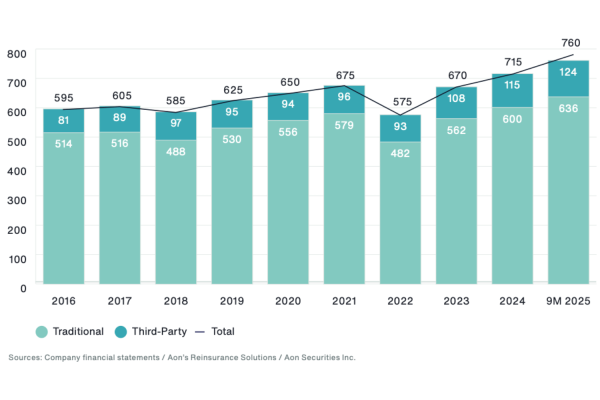

Interesting to see what happens to demand amid surge in non-traditional lines: Flandro, Howden Re

David Flandro, managing director, head of industry analysis and strategic consulting at reinsurance brokerage Howden Re, said the company expects non-traditional lines to surpass the broader property and casualty insurance market by 2030 and will pay close attention to changes in reinsurance demand. In a recent video interview with Reinsurance News, Flandro said there are…

Liberty Specialty Markets appoints Ed Louth as Head of Aviation

Liberty Specialty Markets (LSM), a division of Liberty Mutual Insurance Group, announced the appointment of Ed Louth as head of aviation operations. Louth succeeds Miles Taffs, who joined LSM in March 2025 as senior aviation underwriting specialist and was appointed interim aviation director in September 2025. Taffs will return to his original role while supporting…

K2 International acquires Rising Edge’s Management Liability business

Insurance services holding company K2 Insurance services is expanding its financial capabilities with the acquisition of the managed liability underwriting business of specialist insurer Rising Edge. The acquired team will be integrated into K2 Group Holdings Limited (K2 International) and operate as a newly named division, K2 Executive Risk Limited. Yoel Brightman, a D&O market…

Marsh names Lisa Quest as UK CEO

Insurance and reinsurance broking group Marsh has expanded Lisa Quest’s responsibilities to include the role of UK chief executive (CEO), effective April 6, 2026. She succeeds Chris Lay, who is retiring from the company. Quest, currently head of UK and Ireland at Oliver Wyman, will work with Marsh UK business leaders to develop the company’s…

Reinsurance cycle shows signs of stability, but T&Cs to face strain: Autonomous

New research from Autonomous suggests there is reason to be optimistic that the current reinsurance cycle is “somewhat more rational” than previous reinsurance cycles, although terms and conditions will come under increasing pressure as 2026 progresses. Autonomous explains in a new report that reinsurance cycles are often determined by simple supply and demand dynamics, which…

Walter Voigts-von Foster becomes CEO of Munich Re Africa

Walter Voigts-von Foster has been appointed Chief Executive Officer (CEO) of Munich Re Africa, a role he will hold concurrently with his role as head of non-life insurance. “It is a privilege to lead such a fantastic team and I am excited about what we will continue to achieve together as we realize our future…

Price Forbes expands cross-class Lectio facility to Bermuda

Global specialist broker Price Forbes has announced the launch of its cross-category following facility Lectio in Bermuda, expanding the facility’s premium coverage to approximately $1.3 billion. The facility will initially offer Bermuda property insurance, enabling Price Forbes Bermuda to automatically track pre-approved Bermuda property placements with leading insurance companies, with premium coverage estimated at approximately…

Aon appoints Alexander Krasavin as Regional Managing Director, APAC

Global insurance and reinsurance brokerage group Aon has announced the appointment of Alexander Krasavin as regional managing director for Asia Pacific. In his new role, Krasavin will drive the integration of human capital solutions for Aon’s largest multinational clients in Asia Pacific, while continuing to support clients as a leader in enterprise accounts. He has…

PERILS ups October Australia east coast SCS insured losses to AUD 1.512bn

Zurich-based catastrophe insurance data provider PERILS has revealed its second industry loss estimate for Australia’s east coast severe convective storm (SCS), which affected Queensland, New South Wales and Victoria between October 26 and November 1, 2025, costing the insurance market A$1.512 billion. In line with its Australian insurance coverage definitions, PERILS explained that this estimate…