Zurich Insurance updated its global catastrophe treaty on Jan. 1, increasing capacity and adding cyber insurance to its top global catastrophe excess loss treaty and achieving higher retention rates for its European all-risks reinsurance tower.

In addition to its 2025 results, global insurance company Zurich also announced its 2026 catastrophe reinsurance coverage, emphasizing overall stable renewal conditions and favorable pricing.

Notably, the insurer renewed its global master catastrophe treaty, which it revived last April after Zurich stopped renewing its master coverage in 2023.

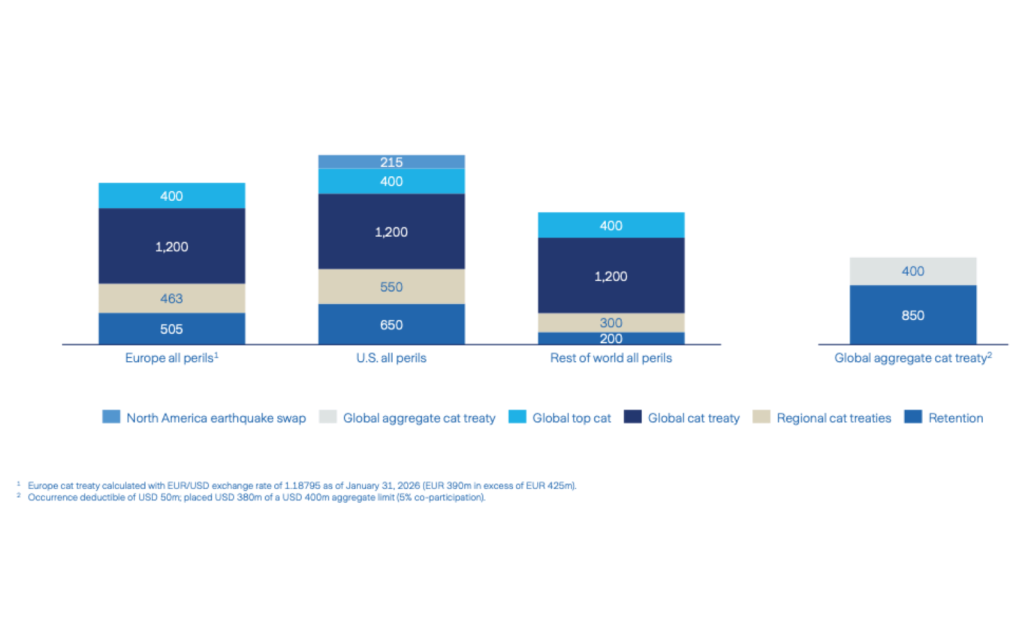

Consistent with the April 2025 renewal, the 2026 1.1 renewal still has a $50 million accident deductible for total coverage, but Zurich places a $380 million limit on the $400 million limit with 5% co-participation, above the $850 million retainer. Back in April, retention rates were the same, but Zurich only set $350 million of the $400 million limit, thus increasing its total underwriting capacity through “risk-adjusted stable pricing.”

This is another sign that reinsurers are more willing to provide frequency protection to meet the needs of the very competitive reinsurance market in 20261.1.

Zurich also updated its European All Risks, U.S. All Risks and Rest of the World All Risks reinsurance towers on January 1, with most content unchanged and just some minor adjustments to European coverage.

Zurich’s European All Risks Reserve has increased to $505 million by 2026 from $486 million last year, while the European Regional Catastrophe Treaty, which sits directly on top of the reserve, has also increased from $446 million to $463 million. Above this level is the global catastrophe treaty, which remains unchanged at $1.2 billion in 2026, while the top global catastrophe treaty at the top of the tower is also unchanged at $400 million.

“Our updates to Global Top Cat XL, including increased network coverage and lower risk adjustments for updated pricing, reflect reinsurers’ confidence in our portfolio,” Zurich said.

The U.S. all risks reserve of $650 million remains the same as last year, with $550 million of U.S. regional catastrophe treaties on top of the reserve, $1.2 billion of global catastrophe treaties, $400 million of global top-tier catastrophe treaties, and $215 million of North American earthquake swaps at the top of the tower.

However, there are some other differences in the 2026 U.S. All Risks Tower compared to the January 1, 2025 renewal, including a $50 million increase in reservations, a $50 million decrease in U.S. regional catastrophe treaties, and a $100 million increase in North American earthquake swaps.

All risk towers for the rest of the world remain unchanged from last year at $200 million, with regional catastrophe treaties at $300 million, global catastrophe treaties at $1.2 billion, and then the global top catastrophe tier at $400 million.

“Other treaties such as the Global Guarantee XOL or the U.S. Liability Quota Share have been renewed under fairly stable conditions and at favorable prices without significant changes,” Zurich explained.

You can view Zurich’s 2026 group catastrophe reinsurance coverage below.

Commenting on the state of the reinsurance market this morning on a media call, Zurich Group Chief Financial Officer Claudia Cordioli said: “Overall, we are seeing a constructive reinsurance market. We are also pleased to see reinsurers being disciplined in terms of terms and conditions, as this is needed to maintain a healthy market for all participants.”