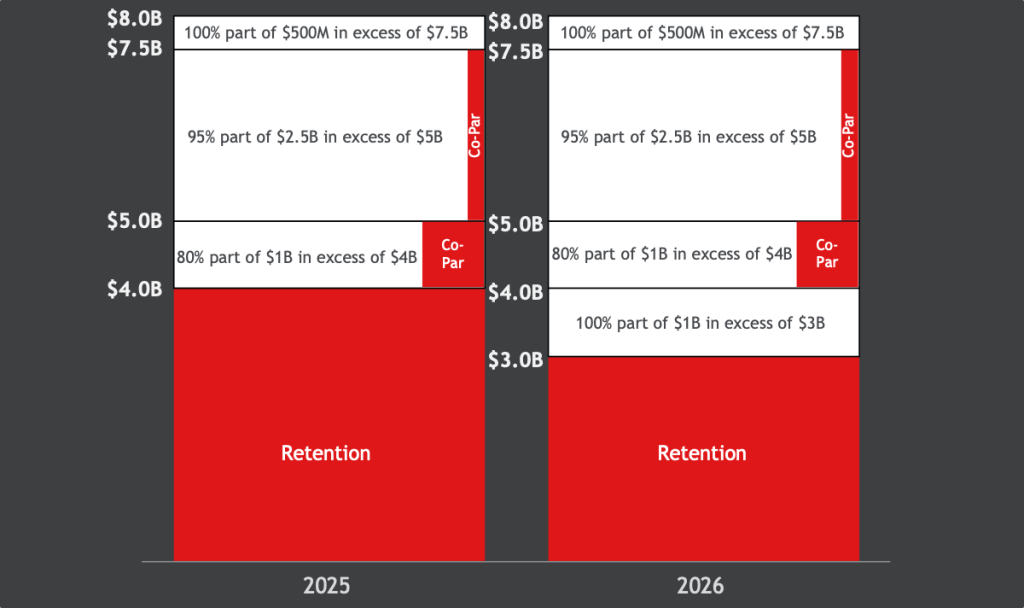

Travelers has unveiled its new catastrophe excess of losses (XoL) reinsurance program for 2026, which features a significant reduction in retention and the addition of a new lower tier.

The planned retention level for 2026 is $3 billion, which marks a decrease from the 2025 threshold of $4 billion.

This change reduced travelers’ net exposure to medium-sized catastrophic events, and reinsurance was implemented earlier.

Meanwhile, the tower’s total reinsurance recoveries increased to $8 billion above retention, providing total reinsurance recoveries of up to $4.675 billion for qualified losses, up from $3.675 billion in 2025.

As in 2025, qualifying accidents in 2026 will be subject to a $100 million deductible.

The renewal is consistent with broader trends seen at renewals on January 1, when U.S. property catastrophe reinsurance prices fell more than expected amid ample capacity and a relatively mild 2025 Atlantic hurricane season.

Reinsurance brokers note a well-supplied “dynamic” market, which appears to be enabling buyers like Travelers to negotiate improved structures and potentially lower risk-adjusted rates.

Consistent with this, Travelers recently reported an increase in its combined ratio in both the fourth quarter and full year 2025, driven by higher net income in both periods, along with record full-year operating cash flow of $10.6 billion.

As of January 1, 2026, in addition to the corporate catastrophe excess loss reinsurance treaty, Travelers has several other catastrophe reinsurance agreements in effect, including reinsurance arrangements related to catastrophe bonds (Long Point Re IV), personal insurance catastrophe excess loss treaties, Northeast property catastrophe excess loss treaties and commercial insurance earthquake catastrophe excess loss treaties, as well as various other international reinsurance treaties.

Readers can find more information about Long Point Re IV Ltd. (Series 2022-1) Cat Bonds and other bonds in the trade directory of our sister publication Artemis.